Most customers don’t just suddenly disappear. When dissatisfied, they move over to an exit lane and chug along while waiting for an excuse to cut ties to your organization.

If, like many companies, you’re not paying attention when they turn on their blinkers to make that move, you’re making a costly mistake.

To avoid missing your chance to reduce customer churn and bring these customers back into the flow of traffic (where they can fulfill their lifetime value), look first to “customer math” – more specifically, tracking those customers who have already stopped their journey.

Before I go any further, a confession: I’m the guy who took stats classes as electives in college – in other words, a stats geek. And one day last week, two things happened that prompted me to write this post and out myself as such.

First, I was speaking with a client with a huge research department. He said no matter what they tried, they were unable to cleary define who was in that exit lane. Second, I was introduced to a new platform, Predict iQ from Qualtrics. That got me thinking.

The beauty of statistics, calculated correctly, is that they provide a clear vision of what has happened, much like many surveys do. Customer satisfaction (CSAT) and customer effort (CES) scores, and NPS (the Holy Grail of CX measurement) all reflect past experiences. And our clients typically measure all of these things.

But the best CX programs use these metrics, along with operational data, to analyze and predict how they impact key outcomes and goals.

So now you have two methods to use “customer math” to reduce churn: find a stats geek like me to run the regressions or let Predict iQ do all the heavy lifting for you.

Whichever route you choose, here are three steps to take to save those customers who are on their way out the door:

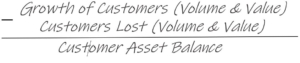

The first competency in Jeanne Bliss’s Chief Customer Officer 2.0 is “honor and manage customers as assets,” defining the concept of customer math as the most important company metric.

She expresses the equation this way:

The delta between those two metrics drives growth. But most companies typically only celebrate gaining customers, without discussing or measuring their loss in any real way.

The delta between those two metrics drives growth. But most companies typically only celebrate gaining customers, without discussing or measuring their loss in any real way.

If you had the same attitude about other items on your balance sheet, you would be overstating the value of your assets! Few have mastered how to figure out who is leaving and how much they’re worth, but now that you know, you are armed with a powerful weapon for reducing churn.

The next step is to figure out why customers are leaving. You can use several methods to access that key information:

Knowing who left (and why) allows you to predict which customers are in the exit lane right now. That knowledge is key to getting those folks back on track.

The best way to do this is with a statistical customer churn modeling platform. If you already have Qualtrics, you can even use Predict iQ without any additional software! It foresees churn with a high level of statistical accuracy and triggers targeted interventions to prevent it. For example, the system might trigger a drip campaign, prompt a call from a sales agent, or generate an offer on the customer’s mobile app.

Predict iQ uses your survey and operational data (such as products owned, support calls, and customer tenure) to create a statistical model that tracks the likelihood of churn for each customer, even as data points and survey results are updated. Now, in near real time, you can have a clear view of that exit lane and the information needed to divert those customers back into the flow of loyal traffic.

The opportunities these platforms open up might even be enough to turn you into a stats geek like me!